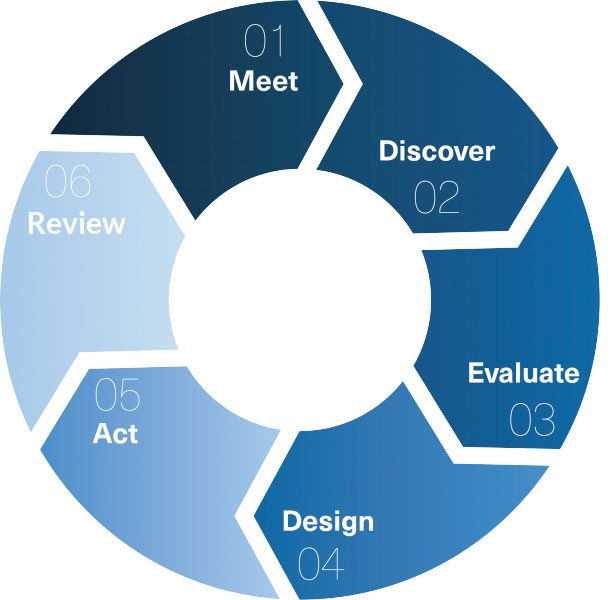

OUR PLANNING PROCESS

What does working with us look like?

The planning process is crucial to help ensure the highest probability of you achieving your goals. We begin by spending time getting to know you and your goals, create a mutually agreed upon plan, implement said plan, review it, and evaluate it over time to remain confident that the plan we design evolves with you and your goals.

1. MEET

Establish and define our relationship with you

We start by assessing a mutual fit and spend our initial conversation learning more about you. This gives us a chance to make sure we can deliver value to you. If you decide to continue the conversation, we will meet either over Zoom or in-person to discuss your goals and review your financial situation.

2. DISCOVER

Gathering data

Once you’ve decided to work with us, we’ll set up a meeting to go through your current financial situation and discuss your short and long term objectives. Our goal is to provide you with clarity on where you are – and where you want to go.

3. EVALUATE

Analyze and evaluate your financial status

This step takes place behind the scenes, as you financial advisor starts to analyze your financial situation and begins formulating your financial plan strategy.

4. DESIGN

Develop your financial plan

Next, we’ll put together a comprehensive financial planning document – a.k.a., a blueprint for your financial independence. The plan is based on our initial conversation, as well as a systematic assessment of your assets, insurance, debts, estate plans, tax situation, and other financial matters. Expect a four to seven page document, not a lengthy binder! Our plans speak to your needs, and are designed to be easy to read and comprehend.

5. IMPLEMENT

Implement the financial plans recommendations

Once your advisor has completed development of your financial plan, they will then take the necessary steps to implement your plan in real life.

6. REVIEW

Review your plan and update when necessary

We’ll keep you abreast of any economic or market fluctuations, and we will review the progress of your plan relative to your defined objectives and suggest any changes where needed.

More Services

Financial Planning

We'll guide you through wealth accumulation, wealth conservation, and wealth distribution.

Investment Allocation

Every investment involves some level of risk. With allocation we can help preserve capital, increase liquidity, and decrease volatility.

Estate Planning

Will the proceeds from your estate be used to fulfill your wishes when the time comes? We can help make sure it does.

Tax Planning

Taxes are a fact of life. But that doesn't mean you can't manage the impact they have on your savings.

Retirement Planning

Whether it's fast approaching or years away, you've likely thought about your retirement. But have you thought about how you're going to get there?

Education Planning

We can offer support and planning as you set education goals for your children, grandchildren, or yourself.